Bringing the family together under one brand

The role of integrated communications management

About the author

Nina Stenning prepared this case study for the PRCA Diploma in Integrated Communication Management, while studying with PR Academy. She has removed the name of the organisation. The budget figures used in this case study are hypothetical and for illustrative purposes.

This new financial services brand which provides independent financial planning and ongoing advice to wealthy individuals has eight highly successful independent financial advice (IFA) businesses located around the UK.

Over time, the intention is for all eight of these businesses to adopt the same name and corporate identity.

THE CONTEXT

There are fewer than 5,000 independent financial advisers in the UK[1]. When you compare this to the number of accountants[2] who, you could argue, perform a similarly demanding and technically complex role, it would suggest there’s room for a new IFA brand.

However, while the low number of IFA firms does present significant opportunities, the industry also has a major challenge in how it is perceived. According to research by My Pension Expert, 57% of Britons say they wouldn’t trust an adviser[3], despite separate research showing that 90% of people who had paid for independent financial advice said it was worthwhile[4].

This means that, as a brand, our company needed to have a clear purpose and be able to maintain trust among its existing clients and engender trust with new target audiences. We needed to build on what had been done to date with a more formal integrated communications strategy in order to:

- understand and address the challenges and opportunities facing the new brand

- encourage and maintain internal stakeholder engagement following the brand launch

- establish ways in which the company can clearly, consistently and authentically tell

its story

DEVELOPING A STRATEGIC MINDSET

The marketing plan that was already in place focused on how the development of a national brand will benefit consumers and create additional value for the group’s stakeholders. We need to expand on this by using additional planning tools to ensure we have the right strategy and objectives to achieve the aims of the business.

I used the POSTAR framework[5] for this purpose:

Position: A new brand in independent financial advice, comprising eight highly successful IFA businesses who have their own client base and a high rate of referral business (c. 75%).

Objectives:

- Launch the new IFA brand and cross-hub marketing approach, within a budget of £200k and six months from agreement of the new name.

- Rebrand all acquired businesses within two years of their joining the main brand (budget of £20k per business).

- Deliver the first paid marketing campaigns to run in March 2022, aimed at growing awareness of the main brand and targeted at asset rich 45 – 59 year olds with £200,000 or more to invest.

Strategy: A phased approach: 1. Foundation – business acquisition and integration. 2. Build and refine – improve insight and digital capability. 3. Evolve the brand – marketing insight and measured campaigns.

Tactics: A group website and social media presence, marketing campaigns and content provided to acquired businesses to help them grow. A national marketing effort using Paid, Earned, Shared and Owned (PESO) channels.

Administration: A four-strong central marketing team including insight, content strategy, marketing communications and brand development / governance. They will work with existing marketing resource across the group by way of a virtual marketing forum.

Results: Wealthy people trust our brand and come to us for their financial planning. Regional businesses convert campaign leads into financial planning clients that add to their bottom line, increasing the value of the group overall.

The existing marketing strategy highlighted a number of challenges and opportunities but it was important to build on these and set them out as a SWOT analysis to further assess our position, identify each strength and weakness and discuss how we maximise opportunities and mitigate the risks caused by threats:

| STRENGTHS

Independent, not restricted Loyal existing client base Supportive Board of investors Businesses in the group are profitable Expertise across the group is exceptional Referral business is high across the group Unique brand purpose and strapline

|

WEAKNESSES

The brand is unheard of Existing digital capability is minimal Hard to achieve brand consistency across multiple businesses Multiple operating models and standards Lack of customer insight Advisers not familiar with marketing |

| OPPORTUNITIES

There will always be trigger events for people needing financial planning There’s no stand-out name in independent financial advice A new brand means a chance to do Customers are there if we know where and when we need to be visible to them A digital-first approach to marketing will give us cut-through over competitors |

THREATS

Public perception of financial advice Lack of succession planning: aging advisers Continued pressure to justify fees Changing regulation and Capital Risk of complaint following a non-compliant financial promotion Risk of reputational damage from a complaint

|

What’s more, we must assess the external factors impacting our business as these also inform our position and therefore our strategic objectives. I’ve used the PESTELIO model for this purpose:

USING INSIGHT TO INFORM OUR STRATEGY

We now have a good understanding of our market position and strategic aims and objectives. From our SWOT analysis we know that existing clients are loyal to their adviser and referral business is high. We also know our strengths and the opportunities available to us in the market. This insight is supported by two others that have come from our marketing research:

- We will create brand equity by developing a national identity which galvanises the business internally and creates further demand (and therefore marketing value) amongst existing clients

- This gives us the platform to run national and regional marketing campaigns to derive additional value from new consumer markets

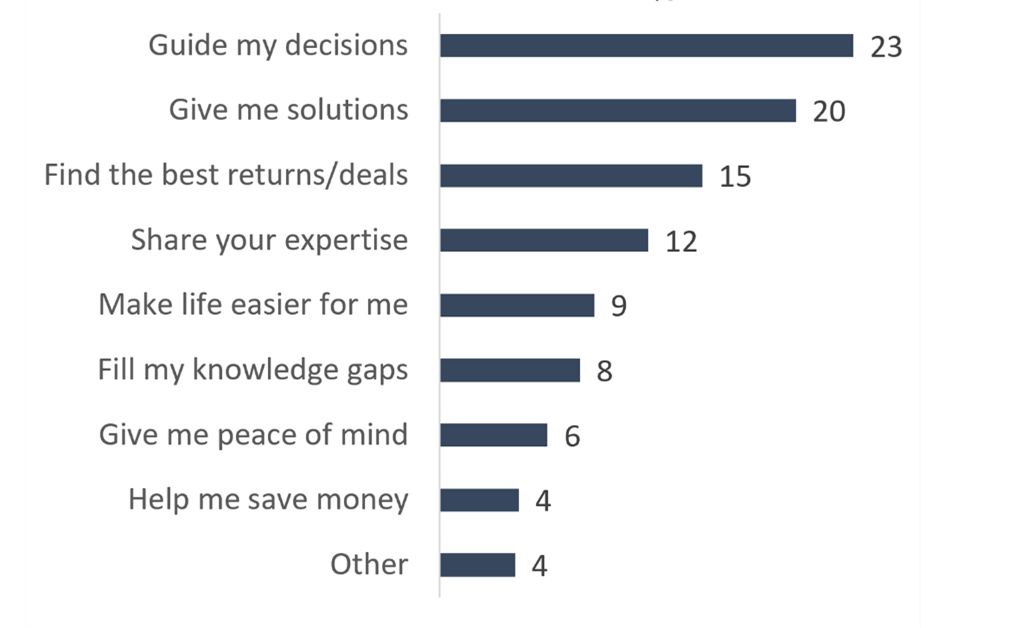

In February 2020, research was commissioned to investigate what drives value in financial services. At the core of this is understanding a person’s primary reason for seeking financial advice and what they value most from their adviser.

On the first question, the research found that those surveyed most valued having someone to guide financial decisions:

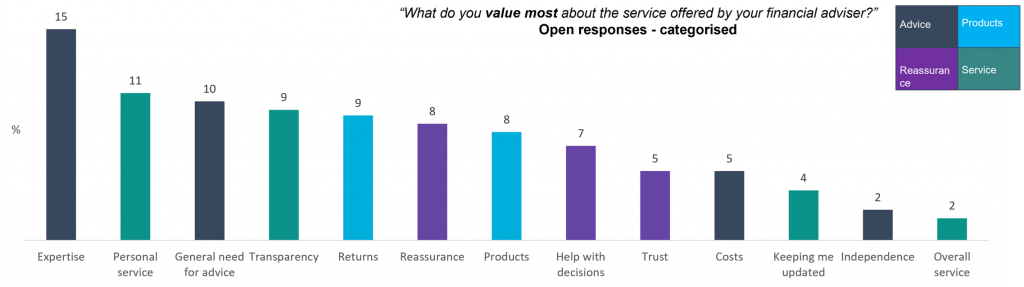

Respondents also said that expertise and personal service were valued most in terms of the services offered by their adviser:

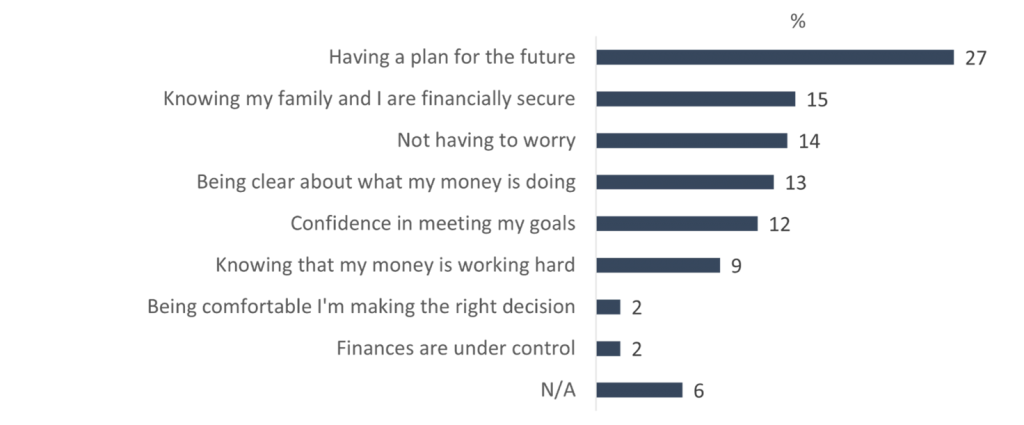

The research also highlighted that peace of mind is important when it comes to a person’s current and future finances:

The insight from this research was central to the development of the brand values, vision, purpose and mission and this helps to differentiate the business from its competitors in achieving its strategic objective of creating value in the group.

DEVELOPING A BRAND PEOPLE CAN TRUST

In developing the new brand, we must be able to articulate the proposition in a way that is simple, motivating and sustainable. We believe we have achieved this by adopting a clear purpose and distinct tagline, which we have registered as a trademark so that we can own this territory. Together, the name, purpose and tagline give a point of difference for the brand and allow us to emphasise the importance of financial planning and the types of emotional triggers where financial advice is of most value (eg. home purchase, marriage, childbirth, divorce, inheritance, death). Looking back at the research findings, this should be of value to our target audience, particularly as we know our competitors tend to focus more on financial advice and products.

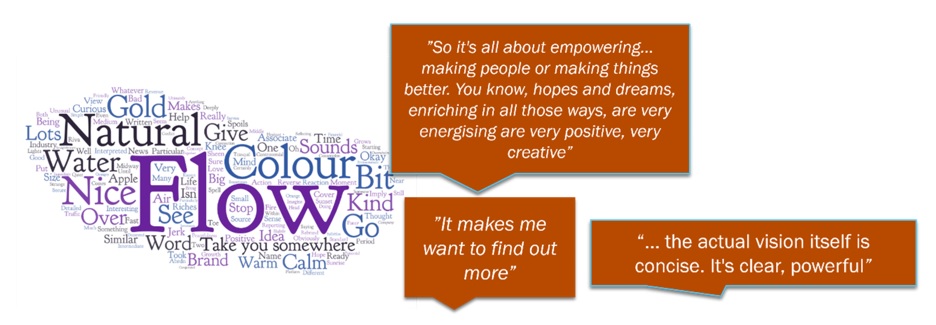

Early on in the brand’s development we also took the opportunity to test the name and tagline with a small sample group.

This was time and money well spent as it confirmed the company’s belief around the strength of the name and purpose and that there were no obvious negative connotations to worry about.

This suggests that our name is one that can engender trust and spark curiosity. However, in order to do this most effectively, we have to recognise the challenges that come with communicating our message and we must have a deep understanding of the attitude, characteristics and beliefs of the people we want to start a conversation with.

MAKING SURE WE’RE HEARD – AND UNDERSTOOD

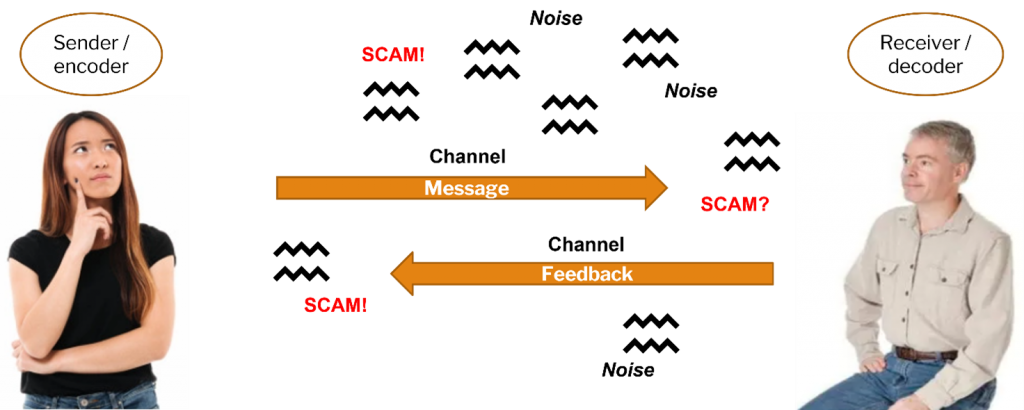

If we look at the two-step model of communication, which builds on Kotler’s one-step communication process, we have to bear in mind encoding, decoding, channels and noise, all of which serve to hamper effective communication:

According to the Communications Adoption Curve, we also know there are particular groups within our target audience who will determine how likely they are to hear our message, act on it, and influence others to do the same.

This reinforces how important insight is in enabling us to develop targeted marketing communications campaigns. While we have done some initial work in identifying target audiences, I recommended we commission further research and, additionally, work with resources including Target Group Indexing (TGI) and Experion to enhance this.

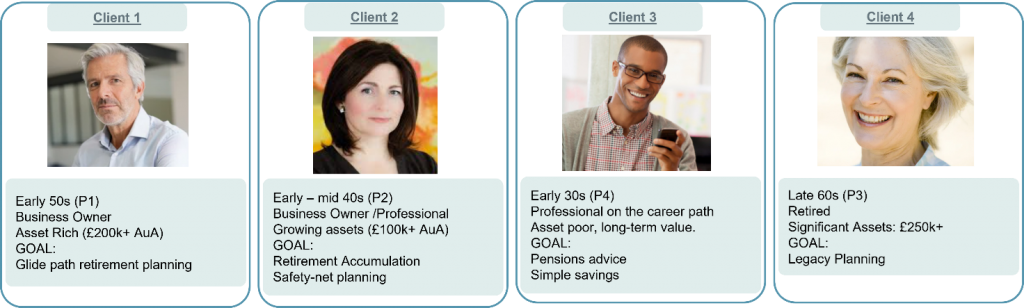

We had already identified four key personas:

This starts to give us a picture of our target audiences, but I felt that we need much richer information and insight into these groups. For instance:

Name | Bio | Family | Job title | Character | Preferred channels | Goals | Pain points | Value proposition | Objections

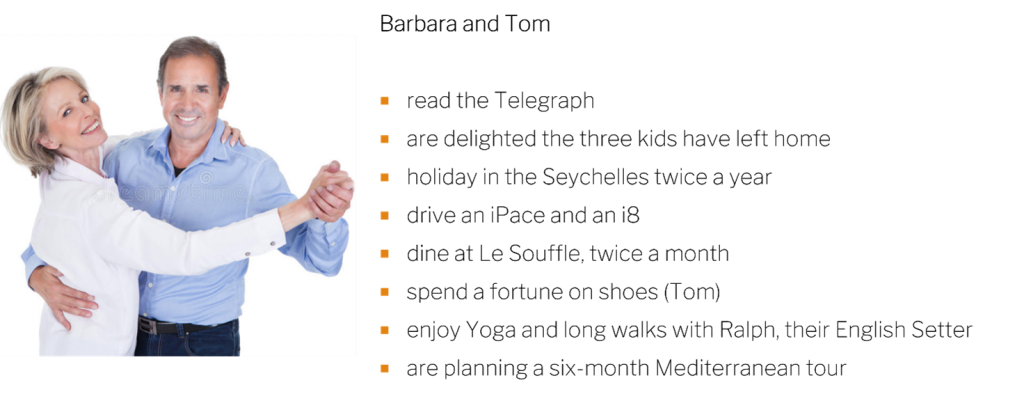

We can then start to build a pen profile and better understand the emotional and rational triggers that will build and sustain trust and provide a positive brand experience for our target market. For instance:

Building a pen picture of this detail enables us to tailor our campaigns and content so that we use the right channels and advertise at the right time, to differentiate ourselves, remind / reassure we’re here, inform and persuade someone to contact us for financial advice.

To lead this work, we should recruit a small, insight-led central marketing team as that’s where I believe we can add most value to the group and our regional businesses (some of whom have their own marketing resource).

When we start to build insight, we can develop an integrated communication strategy in order to ensure brand consistency across all channels and align communication with business objectives. This will consider who the target audiences are and how and where to communicate to engage them and move the business forward.

TACTICAL DEPLOYMENTS AND CHANNELS

Perhaps one of the major strategic areas that hadn’t already been covered in the existing marketing plan was the tactical deployment of our marketing and communications.

Adopting the PESO model[6] is essential in ensuring an integrated approach and some examples and recommendations that were made are shown below:

Paid activity: Assuming we have our insight function up and running, we should plan a paid marketing campaign in Q1 2022. We should also leverage the sponsorships some of our acquired businesses have in their regions and take the opportunity to run some outdoor advertising at local events, which we can cover and share on social media.

Owned: We will continue to commission three pieces of content each week, which we will publish on our group website and share on our social media channels Facebook, Instagram, LinkedIn and Twitter). We will also allow our regional businesses to repurpose the content in order to run targeted local campaigns. We will work with a Direct Marketing agency to run specific, highly-targeted campaigns. These will be insight-led and include print and digital communications, including a dedicated landing page for the campaign call to action and a central appointment booking service to maximise lead conversion rates.

Shared: We will encourage our regional businesses to share content that emphasises our purpose in the communities we serve, linking back to our charity arm and the fundraising efforts running around the country. We will also publish interesting client stories, with a view to creating videos and other rich media that we can publish and share.

Earned: Working with our PR agency, we will develop a proactive public relations calendar for 2022. I recommended that we aim to release a thought-leadership piece every quarter and run profile pieces with key individuals in the group. We will also identify spokespeople within the group, run media training so that they are comfortable dealing with the trade and national press and find opportunities for them to comment on relevant pieces.

HOW WILL WE KNOW WE’VE MET OUR OBJECTIVES?

Measuring the impact of our communications campaigns is essential. We must be able to measure the campaign tactics (output), the reaction of our target audience (outtake) and the action they took as a result (outcome). Here I am referring to the integrated measurement framework launched by the Association Measurement Evaluation and Communications (AMEC).

The AMEC’s Barcelona Principles[7] provide a framework for effective public relations and communications measurement and are a useful tool for us to employ:

- Start by setting goals

- Measurement and evaluation should identify outputs, outtakes and outcomes

- Societal and organisational outcomes and impact should be identified

- Measurement should be qualitative and quantitative

- Don’t use Advertising Value Equivalent (AVE) in determining the value of

the communication - Make sure we measure on and offline channels

- Keep integrity at the heart of our communications practices.

Using the integrated communications measurement framework and taking one of the corporate marketing objectives referred to earlier, we can start to see how best to measure and evaluate our communications activity. This table should be completed for each objective when we are ready to run the campaign:

| OBJECTIVE

· Deliver the first paid marketing campaigns to run in March 2022 at a cost of £x, aimed at growing awareness of the brand and targeted at asset rich 45 – 59 year olds with £200,000 or more to invest. |

INPUTS

· Client data and insight · Budget · Resource · Design |

ACTIVITIES

· Content commissioned · PESO channels · Pay Per Click advertising · Fulfilment |

| OUT-TAKES

· Click throughs / open rates · Subscriptions · Social media conversations · Engagement levels |

OUTCOMES

· Appointments · Online advocacy · Share of search |

|

| OUTPUTS

· Quan and Qual · Website stats · Followers / Connections · Retweets |

IMPACT

· Increase in number of financial planning clients · New business numbers up by x% · Referrals up by x% · Reputation online enhanced · Increase in backlinks · Improvement in Search rankings |

|

FUTURE CAMPAIGN DEVELOPMENT

As we plan future integrated communications campaigns we will look to create a more robust framework that captures the recommendations in this report and serves as a template. One that starts with SMART objectives, builds in measurement and evaluation runs across the PESO channels and has integrity and ethics at the centre.

We know we have a competitive edge with our name and tagline and we can get cut-through if we adopt a digital-first approach. In terms of new clients, there’s an estimated population of three to four million people within our target demographic (45-59 age, top 15% of wealth). And we know the trigger events that cause people to seek financial planning and advice. In fact, every year in England and Wales there are over 100,000 divorces, 650,000 births and 550,000 deaths. These can be highly emotional moments and we can use those to develop a brand that’s human, empathetic and responsive.

At the root of our success will be a deep understanding of the people we believe can benefit from our services. Our next recruit into the team needs to be an insight analyst who understands the various demographic profiling tools like ACORN and TGI, which we will start to employ in our planning process.

In terms of existing clients, we should employ Net Promoter Score (NPS) as a way of understanding and tracking the sentiment of those who receive our services and whether they would refer us to friends and family.

REFERENCES

[1] Norrestad, F. 2021. Statista, Number of financial advisers in the United Kingdom (UK) from 2016 to 2020, URL https://www.statista.com/statistics/317905/number-of-financial-advisers-in-the-united-kingdom-uk/ [Accessed 15 December 2021]

[2] Masters, L. 2021. Nimblefins, Number of accountants in the UK, URL https://www.nimblefins.co.uk/business-insurance/accountant-insurance/number-accountants-uk [Accessed 15 December 2021]

[3] 2021. My Pension Expert, How can Advisers restore public trus, URL https://mypensionexpert.com/2021/03/19/how-can-advisers-restore-public-trust/ [Accessed 15 December 2021]

[4] 2021. OpenMoney, UK Advice Gap Report, URL https://www.open-money.co.uk/advice-gap-2021 [Accessed 15 December 2021]

[5] Morris T., Goldsworthy S. 2008. POSTAR, a PR planning aid. In: Public Relations for the New Europe, URL https://link.springer.com/chapter/10.1057/9780230594845_10

[6] Robinson, S. 2021. What is the PESO model for marketing, URL https://www.brilliantmetrics.com/knowledge/blog/what-is-the-peso-model-for-marketing/ [Accessed 14 December 2021]

[7] Barcelona Principles 3.0: an overview, 2021 AMECORG.COM, URL https://amecorg.com/barcelona-principles-3-0-translations/ [Accessed 12 December 2021]